Estimate my 2021 tax refund

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. W-4 Pro - Tax Return Based W-4 Form.

Benefits Of Income Tax Return Filing Before Due Date Itr Filing Rules Income Tax Return Income Tax Income Tax Return Filing

Montana Individual Income Tax Return Form 2 2021.

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Use this calculator to help determine whether you might receive a tax refund or still owe. Get Your Max 2021 Tax Refund.

Aprio performs hundreds of RD Tax Credit studies each year. Wondering what to expect when you file your taxes this year. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Gather your required documents. Ad No More Guessing On Your Tax Refund. For example if you are a single person the lowest possible tax rate of 10.

Start with the 2021 Tax Calculator - TAXstimator- and estimate your 2022 Tax Refund or Tax Return. Have the full list of required tax documents ready. Over 40525 but not.

19 hours agoEligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income tax liability. Up to 10 cash back Estimate your federal tax refund for free today. Initially it was not.

If you have more than one IRP5IT3a please enter totals for all of them added. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. Montana Individual Income Tax Return Form 2 2020.

And is based on the tax brackets of 2021. Receive Fast Free Tax Preparation Quotes From The Best Tax Accountants Near You. Estimate Today With The TurboTax Free Calculator.

The new federal tax filing deadline is automatic so you dont need to file for. Including a W-2 and. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Use your estimate to change your tax withholding amount on Form W-4. Which tax year would you like to calculate. Ad Calculate your tax refund and file your federal taxes for free.

Individual taxpayers may defer tax payments until the new filing deadline interest and penalty free. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Or keep the same amount.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Click here for a 2022 Federal Income Tax Estimator. After You Use the Estimator.

Did you work for an employer or receive an annuity from a fund. Beyond this date use the 2021 Tax Return Calculator below to estimate your return before filling in the forms online. Use our 2021 tax refund calculator to get your.

It is mainly intended for residents of the US. 2021 Tax Calculator Free Online. 99500 plus 12 of the excess over 9950.

Up to 10 cash back Estimate your federal tax refund for free today. After 11302022 TurboTax Live Full Service customers will be able to amend their. The state noted that.

When figuring your estimated tax for the. How does the tax return estimator work. 2021 Tax Calculator Free Online.

As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 202122 income year. 2022 Tax Calculator Estimator - W-4-Pro. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc.

The base amount for the 202122 income. 2021 Returns can no longer be e-filed as of October 17 2022. Estimate your 2021 tax refund today.

10 of the taxable income. Ad Calculate your tax refund and file your federal taxes for free. Did you withhold enough in taxes this past year.

Use our 2021 tax refund calculator to get your. Get Your Max 2021 Tax Refund. Up to 10 cash back Your tax bracket shows you the tax rate that you will pay for each portion of your income.

Wondering what to expect when you file your taxes this year. I had 51500 estimate taxes for state carried over to this year. Then income tax equals.

To change your tax withholding amount. In 2021 I paid a penalty that would be refunded to me with my 2021 tax return. A Simple Step-By-Step Process To Help Guide You Through Calculating Your Taxes.

Over 9950 but not over 40525. Ad Finding a tax return consultant in your area is easy with Bark.

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Free Income Tax Efiling In India Cleartax Upload Your Form 16 To E File Income Tax Returns Filing Taxes Tax Refund Income Tax Return

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

What Is A 1040 Form

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

2020 2021 Tax Estimate Spreadsheet Income Tax Capital Gains Tax Tax Brackets

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Do You Need To File A Tax Return In 2022 Forbes Advisor

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

When Will I Receive My Tax Refund Will It Be Delayed Forbes Advisor

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

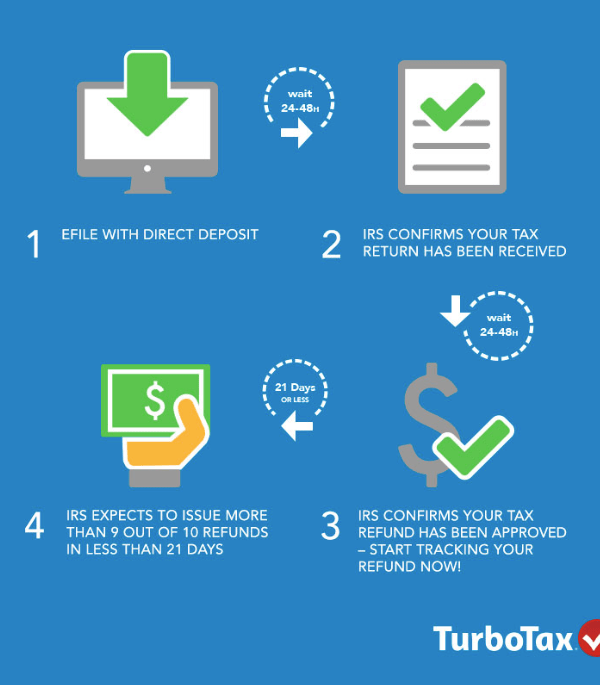

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Where S My Tax Refund How To Check Your Refund Status The Turbotax Blog

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

What Is A 1040 Form

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll